Clark County assessor

Click here for mobile version. Generally speaking taxable value of real property is the market value of the land and the current replacement cost of improvements less statutory depreciation.

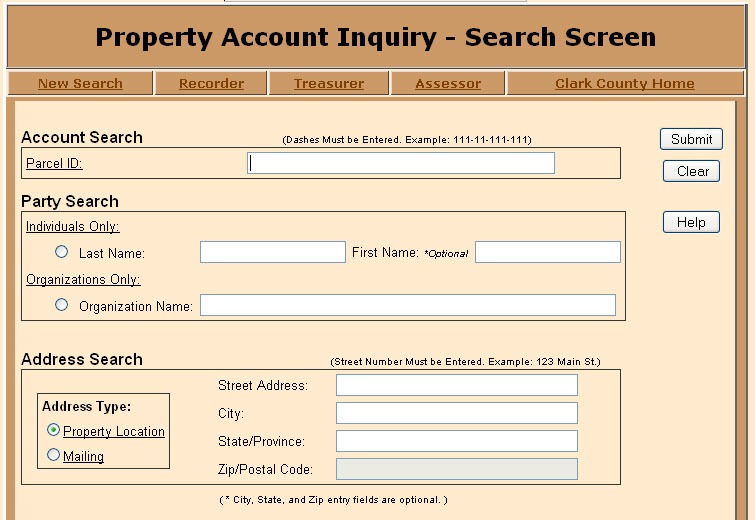

Although multiple criteria can be entered to narrow your search results you are not required to complete each criteria.

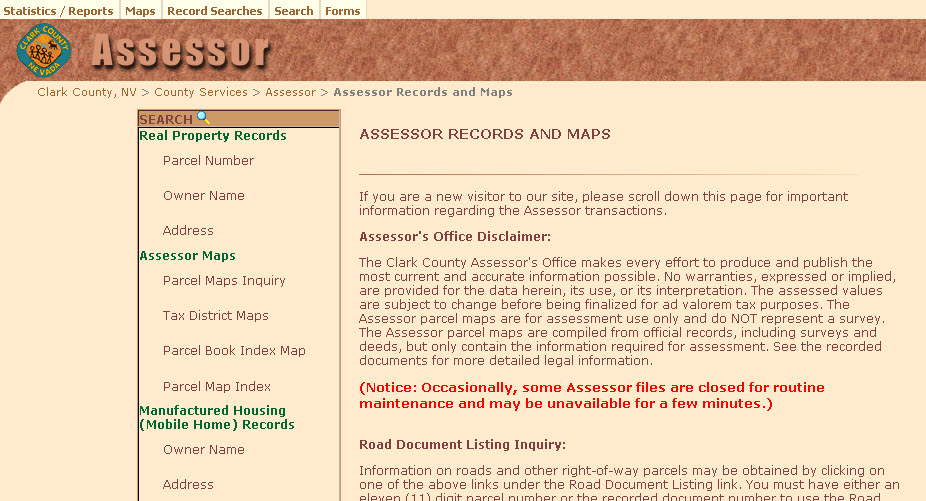

. You can call us at 5643972391 or email at assessorclarkwagov to schedule. The Clark County Assessors Office makes every effort to produce and publish the most current and accurate information possible. Clark County Property Tax Inquiry.

Government Center 500 South Grand Central Parkway Las Vegas Nevada 89155-1401 702-455-3882INFORMATION. Clark County Assessor Peter Van Nortwick is available to speak at neighborhood meetings and to business groups. The assessed values are subject to change before being finalized for ad valorem tax.

In fact you will likely have better results with less criteria. Add What is the difference between a property tax levy and a property tax levy rate. No warranties expressed or implied are provided for the data herein its use or its interpretation.

Your feedback helps improve OpenWeb For improved performance and additional functionality visit this site using Chrome or Edge. Its county seat and largest city is Vancouver. The Clark County Assessors Office locates identifies and appraises all taxable property accurately uniformly and equitably in accordance with Indiana law.

It was the first county in Washington named after William Clark of the Lewis and Clark ExpeditionIt was created by the provisional government of Oregon. Welcome to the Assessors Office. Each year the Assessors Office identifies and determines the value of all taxable real and personal property in the county.

These values are used to calculate and set levy rates for the various taxing districts cities schools etc in the county and to equitably assign tax responsibilities among taxpayers. Web - enabled software consulting 2002 All rights reserved. Website for Clark County Arkansas.

Clark County Home History Assessors Office Circuit Clerk. It is our goal to serve the public with integrity in a helpful professional knowledgeable and timely manner. House Number Low House Number High Street Name.

Developed by ASIX Incorporated. 830 - 430 pm. Our employees are empowered to improve themselves and the Assessors.

Taxable value is the value of property as determined by the Assessor using methods prescribed by Nevada Revised Statutes and the Department of Taxation regulations. Clark County is the southernmost county in the US. Clark County Parcel Search.

Sale Price Min Sale Price Max Sale Date Min MMDDYYYY Sale Date Max MMDDYYYY. State of WashingtonAs of the 2020 census the population was 503311 making it Washingtons fifth-most populous county. Courthouse Square 401 Clay St Arkadelphia Arkansas 71923.

In an effort to assist you in locating the desired parcel we have provided for a number of search criteria options.

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

How To Get To Clark County Assessor Recorder S Office In Las Vegas By Bus

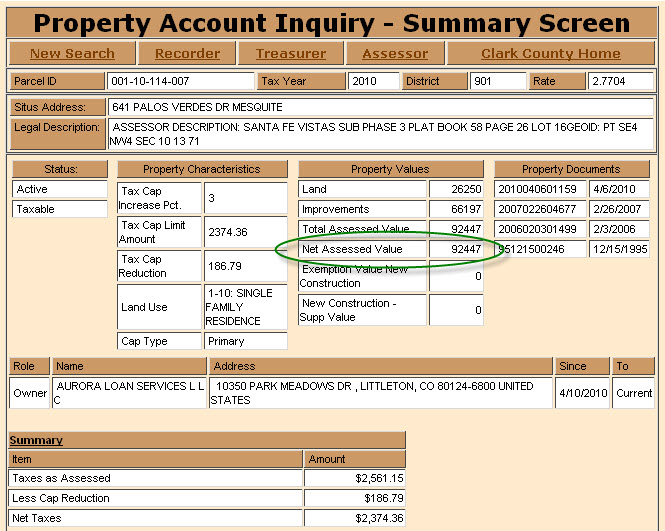

Mesquitegroup Com Nevada Property Tax

Clark County Assessor S Office To Mail Out Property Tax Cap Notices Youtube

Clark County Assessor Briana Johnson Talks About Property Assessments In The Valley Youtube

Clark County Assessor 3211 N Tenaya Way Las Vegas Nevada Us Zaubee

Mesquitegroup Com Nevada Property Tax

Clark County Assessor And Recorder Public Services Government 3211 N Tenaya Way Las Vegas Nv Phone Number Yelp

Are You Paying The Right Amount For Property Taxes

Clark County Recorder Assessor Northwest Branch On Tenaya Way Now Open

Mesquitegroup Com Nevada Property Tax

Mail From The Assessor S Office Cook County Assessor S Office